Advantages of Fixed Exchange Rate System

Borrowers issue bonds to raise money from investors willing to lend them money for a certain amount of time. John Beardshaw has argued that A floating exchange rate helps to insulate a country from inflation elsewhere.

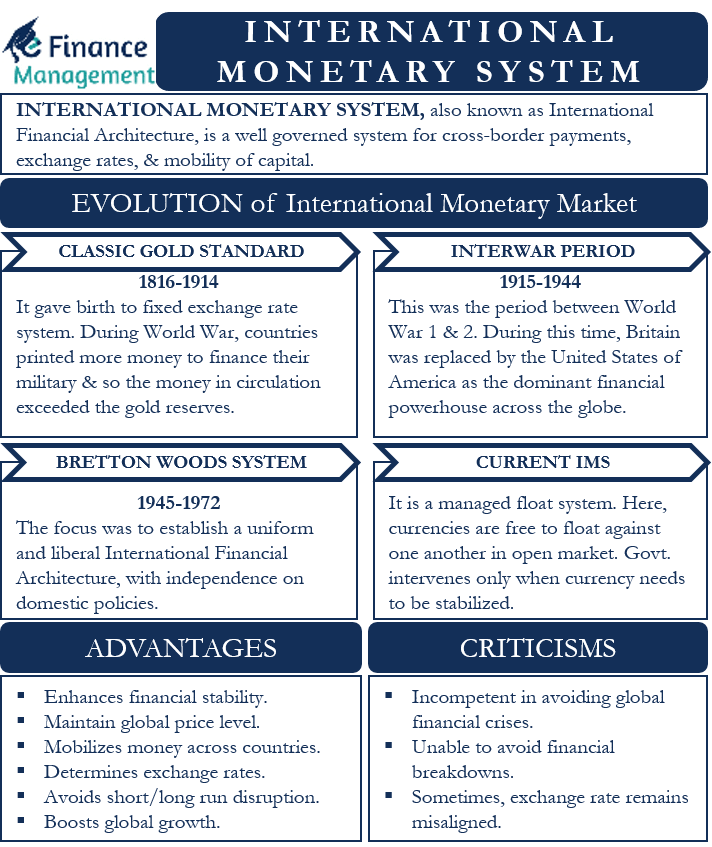

International Monetary System Meaning Evolution Criticisms More Efm

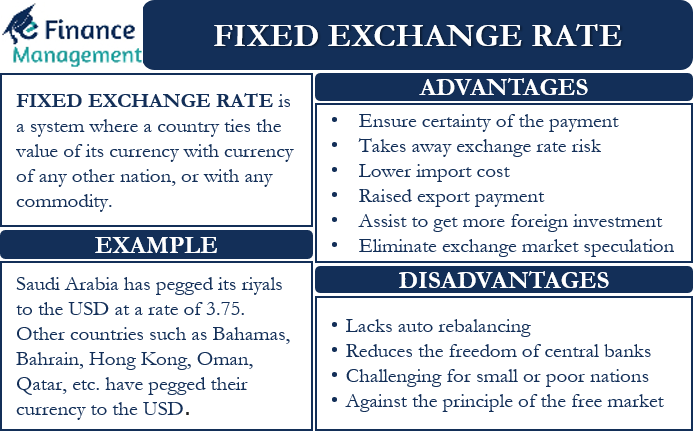

Certainty - with a fixed exchange rate firms will always know the exchange rate and this makes trade and investment less risky.

. A fixed exchange rate means that you will always get the same value for your money in the base currency and will be given the same exchange rate every time. The coupon rate is fixed at the time of issuance and is paid every six months. How these could have been dealt with under a system of fixed exchange rate is not yet clear.

Moreover state authorities find it convenient to levy indirect taxes because they are collected directly at the storesfactories which helps in saving a lot of time and effort. An Australian firm has just bought some machinery from a US supplierfor US250000 with payment due in 3 months time. Fixed exchange rates were popular before the Great Depression but.

The government pledges to buy and sell as much of its currency as needed to keep its exchange rate the same. The pace of growth in reserves was so. Advantages and disadvantages of exchange rate systems Advantages and disadvantages of fixed exchange rates Advantages of fixed exchange rates.

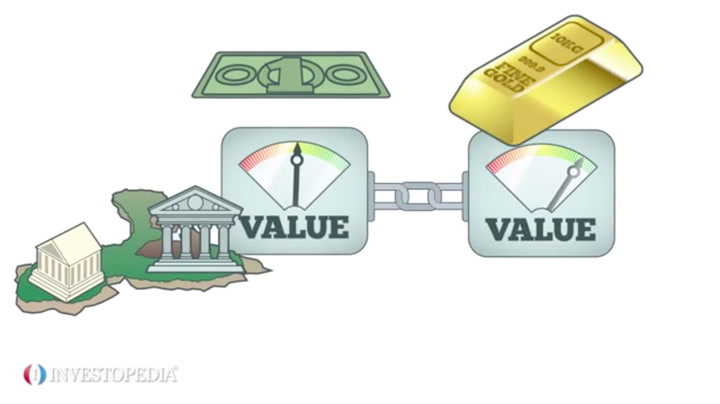

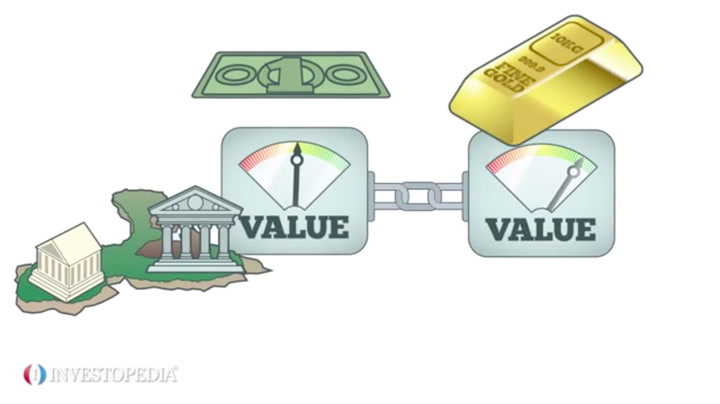

A fixed exchange rate often called a pegged exchange rate is a type of exchange rate regime in which a currencys value is fixed or pegged by a monetary authority against the value of another currency a basket of other currencies or another measure of value such as gold. Test your understanding 1. Before repealing the fixed-rate scheme in 2010 Chinese foreign exchange reserves grew significantly each year in order to maintain the US.

Also currencies can be forced out of the fixed exchange rate undermining its supposed benefits. The system has the added advantage of recordable DVD drives. As the Bretton Woods System collapsed this exchange rate was abandoned in 1971.

Instead they are sold at a discount to their face or par value. Several stop-gap measures were taken but uncertainty and confusion in. She had the advantage of a good education.

Here are the main advantages of indirect taxes. Managed Float System has been in place since 1976 with the Jamaica Agreement. The exchange rate can change only when the government decides to change it.

Advantages of fixed exchange rates. The reasons to peg a currency are linked to stability. A bond is a debt security similar to an IOU.

Advantages of Indirect Tax. A fixed exchange rate is typically. A fixed or pegged rate is a rate the government central bank sets and maintains as the official exchange rate.

He could have taken advantage of the moment. In return the issuer promises to pay you a specified rate of interest during the life of the bond and. Other Treasury securities such as Treasury bills which have maturities of one year or less or zero-coupon bonds do not pay a regular coupon.

Leveraging blockchain technology our mission is to develop a decentralized ecosystem that allows regular cloud software to be run as decentralized cloud applications. The forward rate of exchange. Especially in todays.

Exchange rates arequoted as follows. Absence of speculation - with a fixed exchange rate there will be no speculation if people. Advantages of Current International Monetary System.

The forward market is where you can buy and sell a currency at a fixed future date for a predetermined rate ie. Some Advantages Disadvantages Sentences Examples. There are benefits and risks to using a fixed exchange rate system.

In an industry with high fixed costs a single firm can gain lower long-run average costs through exploiting economies of scale. The period 1947-1971 came to be known as fixed but adjustable exchange rate system or par value system or the pegged exchange rate system or the Bretton Woods System. Every advantage has its disadvantage.

Later in 1980 the International Financial Architecture was regulated by G-5 countries. Indirect taxes do not burden the taxpayer and are convenient as they are paid only at the time of making a purchase. These securities are known as Original.

When you buy a bond you are lending to the issuer which may be a government municipality or corporation. For example it would make no sense to have many. Within Ethernity CLOUD the nodes are location agnostic self-replicating constantly spawning around the internet without user interaction exactly as defined in the Ethereum based smart contract.

Advantages of monopolies. This G-5 group has currently turned into G-20 with a group of 20 countries managing the exchange rate on managed float system. Here are some advantage related sentence examples that we use generally on daily basis or occasionally.

Changes in world trade since the first oil crisis of 1973 have caused great changes in the values of currencies. However critics argue that fixed exchange rates can be difficult to maintain it may require high-interest rates and deflating the economy just to keep the currency at its target. Rail infrastructure gas network.

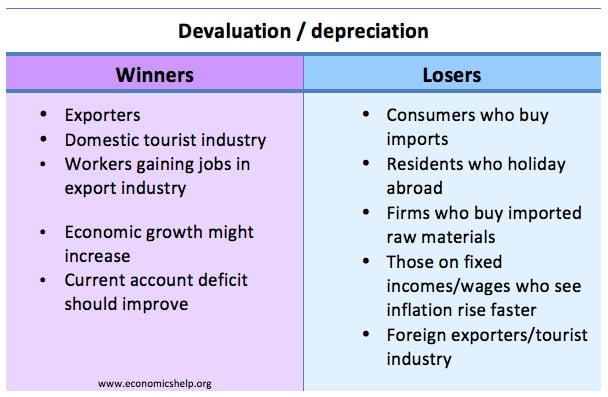

If a government decides to make its currency less valuable the change is called devaluation. However this means that your currency is affected by. Investors receive the full face value at maturity.

Having a fixed exchange rate can give the currency a kind of stability and make financial transactions more consistent and manageable. This is particularly important for firms operating in a natural monopoly eg.

Understanding Exchange Rates Economics Help

Fixed Exchange Rate Meaning Pros Cons Examples And More

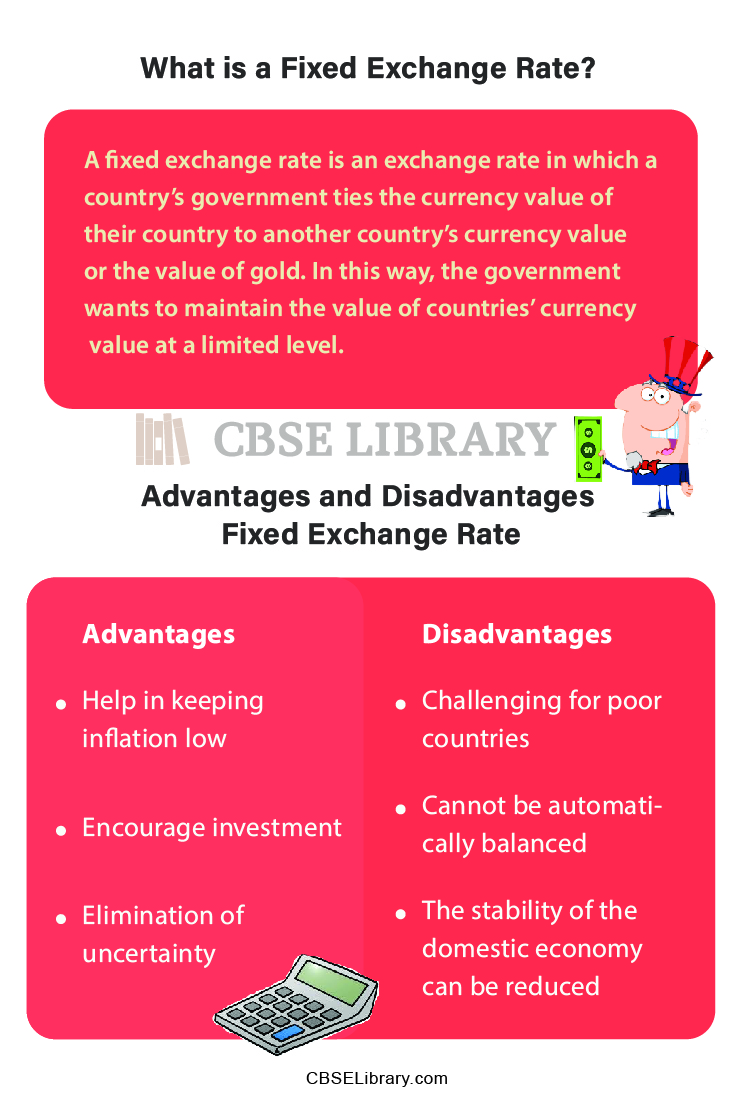

Advantages And Disadvantages Of Fixed Exchange Rate What Is Fixed Exchange Rate Benefits And Drawbacks Cbse Library

Fixed Exchange Rate Advantages And Disadvantages What Are The Major Advantages And Disadvantages Of Fixed Exchange Rate A Plus Topper

Fixed Exchange Rate Definition

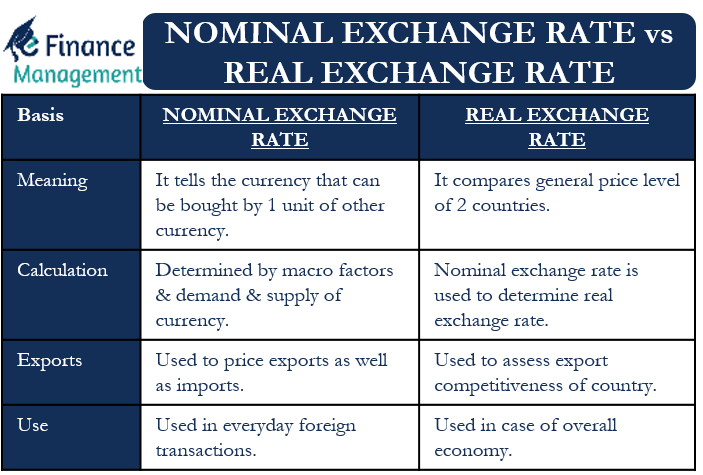

Real Vs Nominal Exchange Rate All You Need To Know

0 Response to "Advantages of Fixed Exchange Rate System"

Post a Comment